We’re putting the power back in the hands of individual investors. While only banks and large institutional investors can typically earn interest on loans, LendingUSA1 is offering individual investors the opportunity to earn interest on consumer loans—just like banks do.

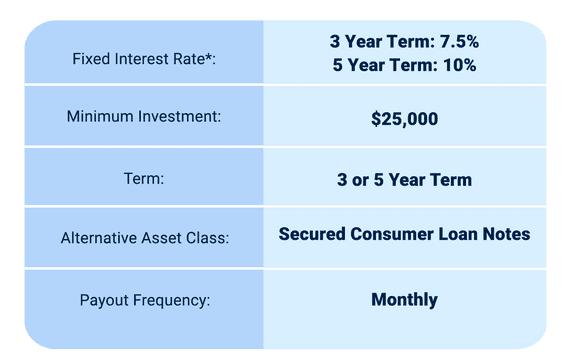

Investing in Secured Promissory Notes means that investors have the opportunity to maximize their returns in a reliable market, earning a fixed monthly income as high as 10% on a five-year term.

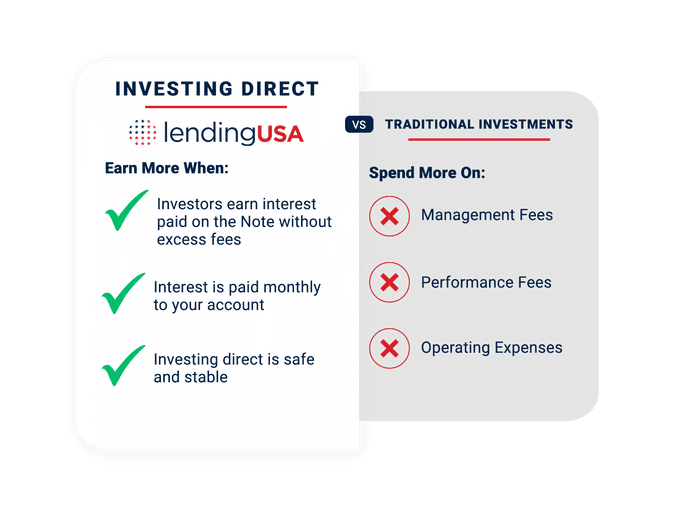

That’s right; LendingUSA wants to level the playing field and restore the power to the investors through Secured Promissory Notes. LendingUSA offers direct and stable monthly fixed income. When you invest with LendingUSA, you get:

- Secured notes

- High yield returns

- Fixed monthly income

What are Secured Promissory Notes?

Secured Promissory Notes are an asset class that generally provide higher yields than most other non-liquid investment opportunities. Consumer credit consists of individual borrower installment loans across varying consumer products and services that typically have low risk, yet provide for steady returns.

Thousands of credit-worthy people apply for loans each month through LendingUSA’s Award-winning loan origination platform. Since these Notes are secured by a diversified portfolio of consumer term loans, it tends to make them safer investment vehicles. Now, through Secured Promissory Notes, individual investors have the opportunity to invest in these assets typically reserved for banks and institutional investors.

Alternative investments are the fastest-growing asset class

As the alternative asset class continues to grow, consumer installment loans have become a multi-billion dollar per year alternative asset class. Compared to traditional investments, alternative investments typically offer less volatility and a fixed rate income, with less reliance on the stock market. While these types of assets have historically been dominated by banks and large institutional investors, companies like LendingUSA are opening the doors to individual investors, providing access that is rarely available.

Why LendingUSA?

- LendingUSA is trusted by over 100,000 borrowers and has facilitated the funding of over $630 million in consumer loans since inception

- Invest with LendingUSA and earn yields between 7.5% on a 3 year term up to 10% on a 5 year term.

- With a fixed monthly income through LendingUSA, our Secured Promissory Notes are a reliable investment

- Alternative investments are a great way for smart investors to diversify their portfolio, now more than ever.

Investing with Lending USA: Get Started Now!

Ready to get started with LendingUSA? Eligible investors2 may fill out a brief form here, and our team will be in touch with you to learn more about your investment goals. It’s easy to sign up! Once you select the right investment for you, you can start generating fixed monthly income.

- Notes issued by LCUSA Echo, LLC, a wholly-owned subsidiary of LendingUSA.

- To be eligible to invest, you must meet certain requirements as established by SEC Rule 506(b) of Regulation D, including either (i) qualifying as an accredited investor as defined by SEC Rule 501(a), i.e., you must have (a) Personal Gross Income greater than $200,000 in each of the last two years (or joint gross income of $300,000 in the past two years), or (b) Personal Net Worth greater than $1,000,000 (excluding your personal residence); or (ii) satisfying certain sophistication requirements either alone or with a purchaser representative.